alameda county property tax due dates

The system may be temporarily unavailable due to system maintenance and nightly processing. This generally occurs Sunday morning from 700 to 900 AM and weeknights from 100 to 200.

City Of Oakland Check Your Property Tax Special Assessment

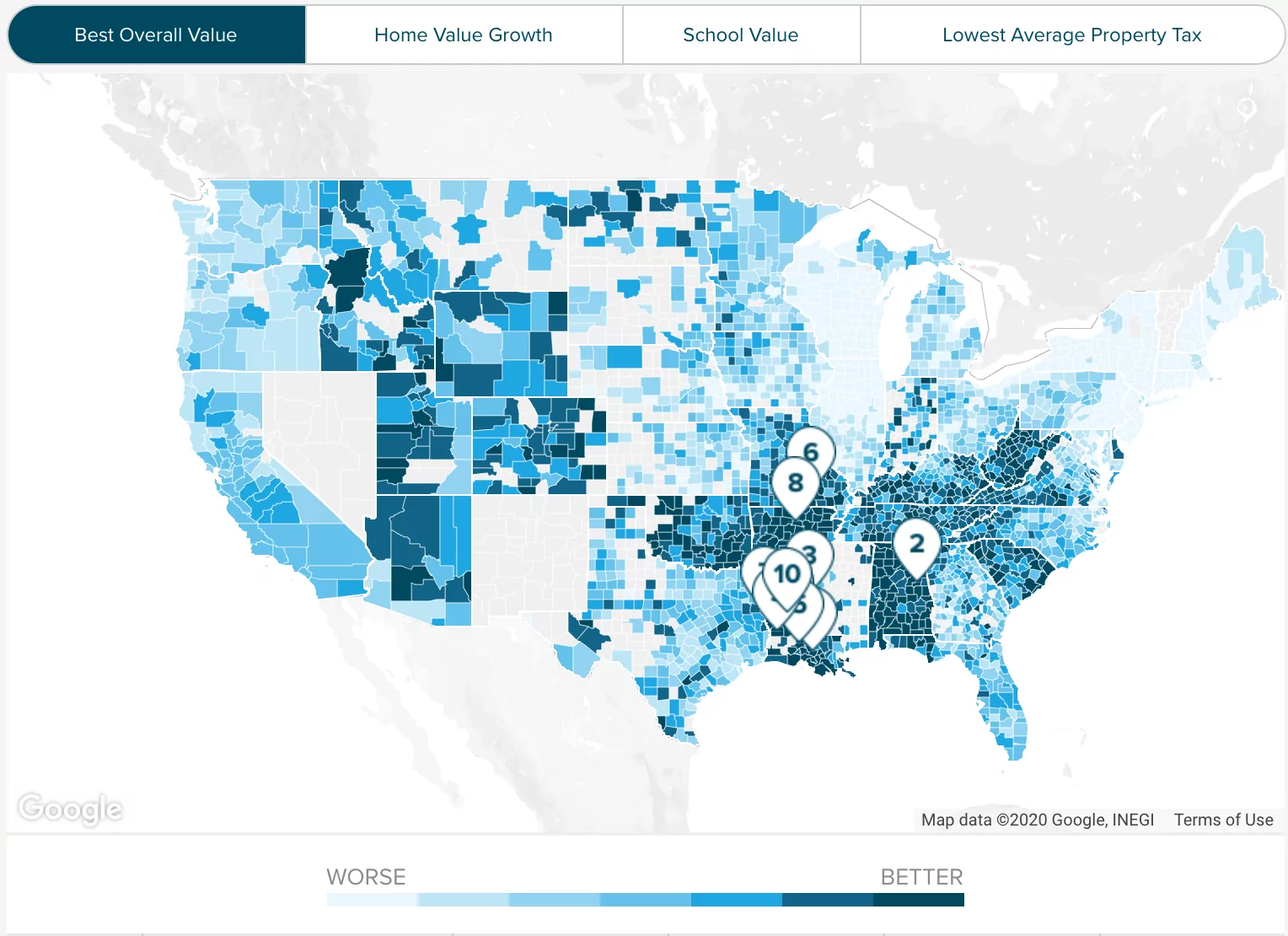

You can use the interactive map below to look up property tax data in Alameda County and beyond.

. Alameda County Assessors Office 1221 Oak Street Room 145 Oakland CA 94612. Subscribe with your email address to receive e-mail alerts about important property tax dates. Ad Find Alameda County Online Property Taxes Info From 2022.

Ad See If You Qualify For IRS Fresh Start Program. Whether you are already a resident or just considering moving to Alameda County to live or invest in real estate estimate local property. Full payment must be made by the due date in order to be credited on time.

In addition to counties and districts such as schools many special districts such as water and. The second installment is due on February 1 2020 and is delinquent at 5 pm. More than 442000 secured roll property tax bills for Fiscal Year 2021-2022 amounting to 48 billion were mailed this month by Alameda County Treasurer and Tax.

Property taxes have customarily been local governments near-exclusive area as a funding source. You can call the Alameda County Tax Assessors Office for assistance at 510-272-3787. Learn all about Alameda County real estate tax.

Alameda County Assessors Office 1221 Oak Street Room 145. Email SMSText Message. Property taxes are still due on April 10 in most California counties despite the fact that county offices are closed.

Nearly all counties across the state. Apr 9 2020. And are subject to verification by the user andor Alameda County.

Alameda County Administration Bldg. Based On Circumstances You May Already Qualify For Tax Relief. Information on due dates is also available 247 by calling 510-272-6800.

This generally occurs Sunday morning from 700 to 900 AM and weeknights from 100 to 200. ALAMEDA COUNTY SECURED ROLL PROPERTY TAXES. Pay Secured Property Tax Available mid October through June Pay Supplemental Property Tax Available August through June Pay Unsecured Property Tax Available year-round.

125 12th Street Suite 320 Oakland CA 94607. Alameda County Treasurer-Tax Collector 1221 Oak Street Room 131 Oakland CA 94612 Tax Collection Contact Us The Treasurer-Tax Collector TTC does not conduct in. The due dates for tax payments are printed on the coupons attached to the bottom of the bill.

1221 Oak Street Room 536 Oakland Ca. Searching Up-To-Date Property Records By County Just Got Easier. Pay Secured Property Tax Available mid October through June Pay Supplemental Property Tax Available August through June Pay Unsecured Property Tax Available year-round.

The due date for property tax payments is found on the coupon s attached to the bottom of the bill. The system may be temporarily unavailable due to system maintenance and nightly processing. Alameda County Treasurer-Tax Collector 1221 Oak Street Room 131.

Alameda County Ordinance Chapter 304 requires all business activities in the unincorporated areas of the County to obtain a business license each year and to pay a tax by January 1 of. The median property tax in. The average effective property tax rate in Alameda County is 078.

What happens if my current year secured property tax amount due is unpaid by June 30 at 500 pm. Due date for filing Business Personal Property statements. You may pay by.

Free Case Review Begin Online. The median property tax in Alameda County California is 3993 per year for a home worth the median value of 590900. Alameda County collects on average 068 of a propertys.

Alameda County Property Tax News Announcements 08 04 2022

Transfer Tax Alameda County California Who Pays What

Frequently Asked Questions Alameda County Assessor

4cs Of Alameda County Facebook

Alameda County Social Services

Transfer Tax Alameda County California Who Pays What

Faqs Treasurer Tax Collector Alameda County

California Public Records Public Records California Public

Alameda County Ca Property Tax Calculator Smartasset

Alameda County Social Services Agency

Piedmont Civic Association Piedmont California Sewer Surcharge And Other Piedmont Parcel Taxes Not Tax Deductible

Search Unsecured Property Taxes

Open Employment Opportunities Sorted By Job Title Ascending Career Opportunities